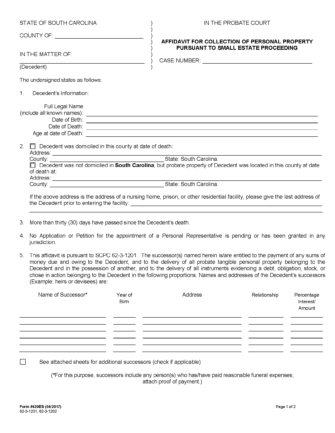

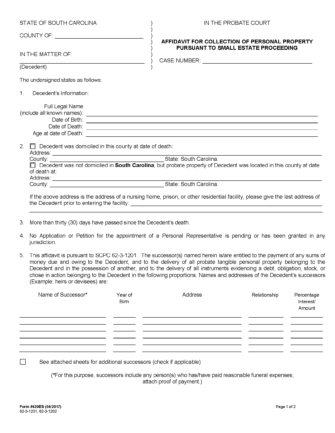

A South Carolina small estate affidavit is a form filed with the probate court that enables the successors of a small estate to expedite the process of retrieving the assets and property therein. This document is known as the “Affidavit for Collection of Personal Property Pursuant to Small Estate Proceeding,” and can only be used for modest estates valued at $25,000 or less. It should be noted that if the deceased owned any real estate, this affidavit may not be used to transfer said property to a successor.

Any person entitled to the decedent’s property may file this affidavit as a claiming successor. The person who paid for the funeral expenses should also be named as a claiming successor and must attach any proof of payments (§ 62-3-1201(a)(4)).

If the successors of a decedent wish to file the Affidavit for Collection of Personal Property Pursuant to Small Estate Proceeding, they must ensure that the following is true and stated in the affidavit form:

Providing the above statements are true, the claiming successor can complete the affidavit including all information contained in Step 1, and attach the original will (if any), and death certificate. They must also list the names of any other successors that have claimed the decedent’s property, and the description and value of the property being claimed. Finally, the value of any liens or encumbrances against the estate must be stated with attached proof.

Once completed and notarized, the affidavit may be filed with the local probate court.

After the affidavit is filed, it will be reviewed by a probate court judge. If approved, the judge will detail the estate’s successors and the percentage they are each entitled to. The original affidavit will be kept with the court while a copy of a court-approved affidavit will be given to the successors to retrieve the decedent’s personal property and distribute it accordingly.